CONSUMER SENTIMENT INDEX

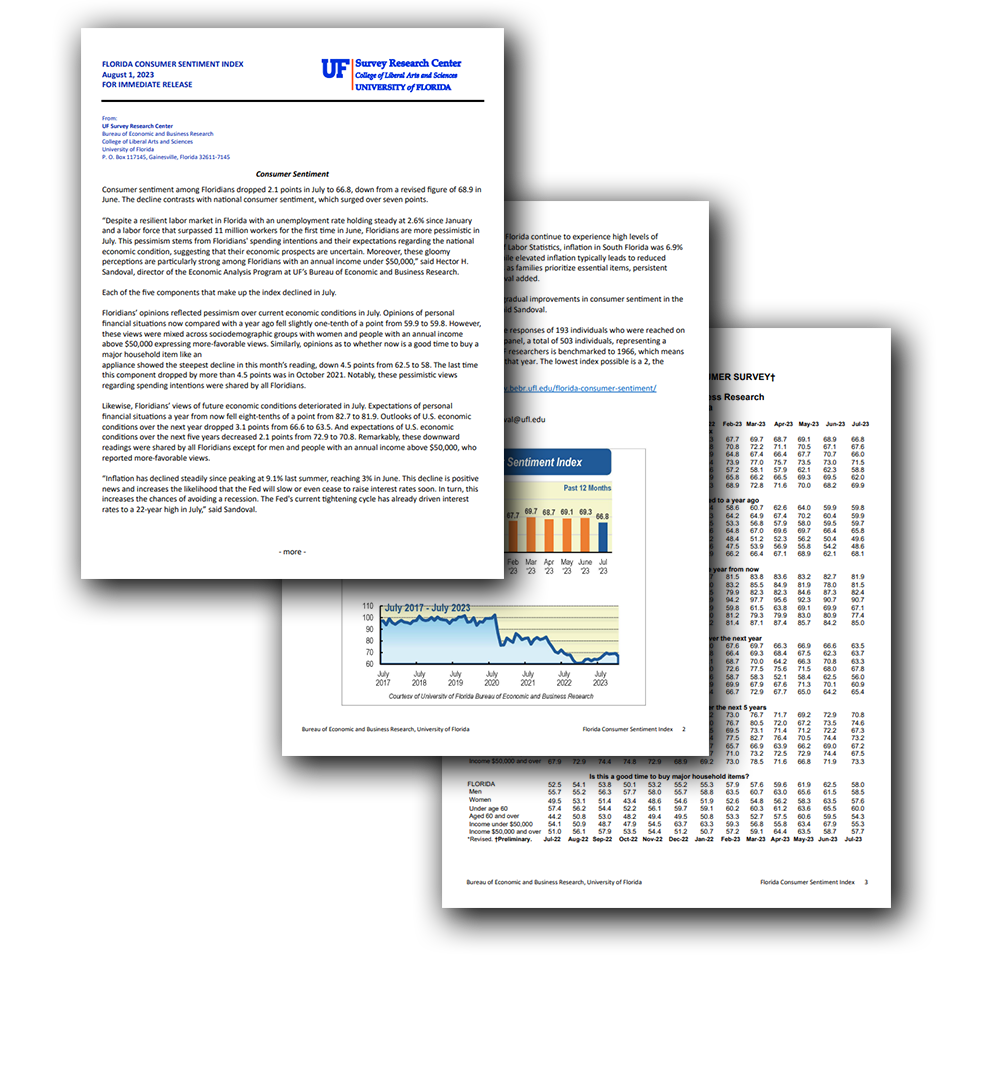

BEBR’s Survey Research Center conducts the monthly Florida Consumer Sentiment Index (CSI) survey which measures consumer’s opinions in various areas of interest. These survey results are then utilized to create the monthly CSI report, which serves to bridge data together by providing insights into future business conditions, consumer attitudes, buying intentions, and inflation expectations. Each CSI report offers a comprehensive overview of the evolving consumer landscape and insight into potential trends for the months ahead.

Method of Surveying

Approximately 150 of Florida’s adult residents are surveyed each month by telephone to gather data for the Florida Consumer Sentiment Index.

Eligibility

Eligibility is determined by confirming if potential participants are 18 years of age or older and ensuring individuals live in a private residence within Florida.

Survey Standards

A maximum of three attempts per record is made, and interviews are conducted in both English and Spanish. Survey length is approximately 9 minutes.

CSI REPORTS

All publications on this page are FREE. Click the Download link to read any report. This survey has been conducted monthly since February of 1985.

The CSI Reports measure consumers’ feelings and willingness to spend. This information is based on the monthly Florida Consumer Attitude Survey conducted by the UF Survey Research Center, a division of UF BEBR. The University of Florida Survey Research Center, also known as UFSRC, is one of the largest and most respected university-based survey programs in the United States.

| Coverage Period | Release Date | CSI Release File |

|---|---|---|

| 1/2026 | Tuesday, February 3, 2025- 10:00 | Download |

| 12/2025 | Tuesday, January 6, 2025- 10:00 | Download |

| 11/2025 | Tuesday, December 2, 2025- 10:00 | Download |

| 10/2025 | Tuesday, November 4, 2025- 10:00 | Download |

| 09/2025 | Tuesday, September 30, 2025- 10:00 | Download |

| 08/2025 | Wednesday, September 3, 2025- 10:00 | Download |

| 07/2025 | Tuesday, July 29, 2025- 10:00 | Download |

| 06/2025 | Tuesday, July 1, 2025- 10:00 | Download |

| 05/2025 | Tuesday, June 3, 2025- 10:00 | Download |

| 04/2025 | Tuesday, April 29, 2025- 10:00 | Download |

| 03/2025 | Tuesday, April 1, 2025- 10:00 | Download |

| 02/2025 | Tuesday, March 4, 2025- 10:00 | Download |

| 01/2025 | Tuesday, February 4, 2025- 10:00 | Download |

Research Articles

Gender gap in consumer expectations

This paper provides empirical evidence of the persistence of gender gaps in consumer expectations regarding personal finances and the national economy’s performance. Using individual-level data from two independent but comparable consumer attitude surveys – one nationally representative of the U.S. and the other statewide representative of Florida – it demonstrates that women are significantly less likely than men to hold optimistic expectations about their personal financial situation and U.S. business conditions over the next year and the next 5 years. These gender expectation gaps, ranging from 5% to 8.5% points, remain highly significant even after controlling for respondents’ socio-demographic characteristics, as well as survey-month and geographic location (including zip code) fixed effects. Furthermore, these gaps are prevalent in both surveys and have been present for more than four decades. Although persistent over time, these gender differences tend to narrow during periods of economic hardship and widen during economic expansions.

Read more about here: https://doi.org/10.1080/13504851.2024.2389339

The role of consumer confidence in forecasting consumption, evidence from Florida

Consumers’ attitudes about the direction of the economy influence their decisions about discretionary purchases, saving, and investment. This paper uses data from Florida’s consumer sentiment index to study the role and accuracy of consumer confidence in forecasting consumption, as well as the mechanism behind such a relationship. Spending on durable goods tends to be more discretionary in nature and it is frequently done using credit, thus potentially more sensitive to changes in consumer attitudes. Our results indicate that the in-sample predictive power of the index and its questions is limited to predicting spending on durable goods, particularly, on autos. Furthermore, consumer confidence does not improve the out-of-sample forecast beyond the forecast from a baseline model, which considers economic fundamentals. Finally, the evidence shows that the relationship between shocks in consumer confidence and economic activity arises because confidence measures contain information about the state of the economy, thus rejecting animal spirits.

Read more about here: https://onlinelibrary.wiley.com/doi/10.1002/soej.12528

Sentiments and spending intentions: Evidence from Florida

Consumer sentiment is considered an important indicator of changes in household spending. However, the evidence of the causal relationship between sentiment and consumption is mixed and scarce. We address this gap using data from the monthly Florida Consumer Attitude Survey, which captures party affiliation, consumer sentiment, and spending intentions since 1991. We employ political partisanship as an instrument for sentiment and find a significant effect of sentiment on spending intentions. Finally, we provide evidence that spending intentions relate to actual spending and show that spending increased among counties with a larger share of Republican voters following the 2016 presidential election.

Read more about here: https://onlinelibrary.wiley.com/doi/10.1111/ecin.13215

Contact Us

Main Office:

352-392-0171

Survey Center:

352-392-2908

Ayers Technology Plaza

720 SW 2nd Ave Ste 150

Gainesville, Florida 32611

PO Box 117148

Gainesville, Florida 32611

Quantitative Research

Add your question(s) to the CSI Survey and gain valuable insights about the economy and mindset of the public.